Spring (and tax season) are soon to be in the air. You should enjoy those first few weeks of warmth instead of worrying about whether you’re accidentally accruing penalties from properly filing your taxes. That’s why we tapped Zachary McArdle, a former CPA with eight and a half years of experience as a credit analyst, and now senior business banking relationship manager with M&T Bank to give some advice to small businesses of all kinds as they prepare for tax season and manage their accounts throughout the year. Read on and let’s see if we can melt a bit of the tax worries away with the rest of winter.

ROI on a CPA

What’s the return on investment for a certified public accountant?

Great question. Like any good tax effort, let’s start off with a little math. Say the cost of a premier CPA to prepare a business tax return and two separate personal tax returns for the owners comes to $4,000, that’s about $11 a day or $5.50 per owner.

M&T highly recommends investing in a CPA for peace of mind alone. You leave so many other things to an expert – preparing your business tax documents, filing your return and advising your tax liability don’t seem like the best “do-it-yourself” projects. Plus, CPAs can help with so much more throughout the year like moves, business purchases, bookkeeping and more. And hey, who can even get a sandwich for $5.50 these days? It’s really not that expensive in the grand scheme of things!

Prepping for your CPA

Before you go to your tax appointment, you should have your entire year of bank statements, major receipts, invoices, contracts and anything else that indicates clean records. A clean record is one with proper support. If your business wants to record something as an expense, there should be a supporting document like a receipt or invoice to back it up.

Below is a list of documents and info to gather before your appointment.

Basic info

-

Last year’s tax return

-

Social security numbers

-

Employer identification number

Income

-

W-2s and 1099s

-

Financial statements

-

Digital currency transactions

Deductions and credits

-

Business mileage and purchases

-

Payroll records

-

Itemized deductions (mortgage, state and local taxes, medical expenses)

-

Charitable donations

-

Health insurance

-

Childcare expenses

-

Retirement contributions

-

College loans/tuition

Software saves time

Accounting software is invaluable for storing your financial data. It can help with anything from invoicing and billing to tax filing. Need a report of your cash flow for a last-minute meeting? That can be done in a click of a button. The convenience and accuracy of accounting software are unmatched. Check out QuickBooks. It’s built to be user-friendly for people with little to no background in accounting. A strong outside CPA will happily guide you on how to navigate and mold your business's accounting software to work best for you.

Helpful hint: The biggest pet peeve Zachary has heard from tax preparers is customers failing to book all entries that the CPA sent when they were preparing their taxes last year. In these cases, the CPA has to go back to the last year and reconfigure what the adjusting journal entries from that year were in order to accurately complete the current tax return. Software can help you avoid being that client!

Quarterly is king

April can be unnecessarily expensive for new business owners as they realize they owe a larger-than-expected tax bill. This is likely because they didn’t pay their estimated taxes quarterly for the prior year. The goal is to pay all the taxes within the year that you are filing to lessen the burden at the end of the year. We understand some clients don’t want to pay during the year, but it’s important to know sometimes you don’t have that option.

The IRS may expect you to pay quarterly tax payments if:

- You’re self-employed and do not have more expenses than income

- You expect to owe $1,000 or more in taxes for the year (after deductions and credits)

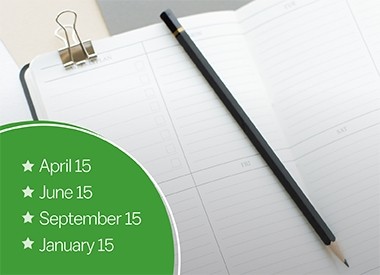

Make sure you ask your CPA if you should be paying quarterly taxes. If these apply to you and you don’t pay quarterly, you may be hit with underpayment penalties from the IRS. To ensure you don’t miss payments, we suggest adding these quarterly payment deadlines to your calendar before reading on. Go on. We’ll wait...

Helpful hint: If these dates ever fall on a federal holiday, Saturday or Sunday, they will be due on the next business day.

Take advantage of tax deductions

Most businesses are not aware of all the tax deductions that may apply to them. Below are links to different IRS deductible pages that may surprise you. Dry cleaning definitely caught us off guard.

- Travel

- Work From Home

- Advertising and Marketing

- Meals and Entertainment

- Client and Employee Gifts

- Profit Sharing

Remember, if you’re talking business, it can be written off as business! Tom Wheelwright, a leading tax and wealth expert, CPA and author of "Tax-Free Wealth" says even meals with spouses where business is discussed is legally a deductible.

There are many industry- and entity-specific tax deductions that every business qualifies for. You can file your deductions with the most confidence and ensure you haven’t missed any opportunities with a trusted CPA by your side.

Keeping records

Businesses are required to keep their tax records for five years, but CPAs recommend seven years to be safe. Why? Well, even if you don’t need records for your taxes, your insurance or financial institutions may still require those documents for applications down the road. In addition, day-to-day records should be captured and stored securely and electronically and backed up at least weekly so that the files are safe.

Here's a good rule of thumb for keeping records according to Meyers Brothers Kalicka Certified Public Accountants.

Permanently

- W-2 forms

- Payroll tax returns

- Retirement plans

10 years

- Payroll tax records

- Workers' compensation

- Employee-withholding-exemption certificates

7 years

- Tax records

- Payroll checks

- Payroll records

- Time reports

- Attendance records

- Medical benefits

- Commission reports

3 years

- Contractor information

- Tip substantiation

1 year

- Bank statements

- Pay stubs

1 month

- Utility bills

Despite popular belief, filing taxes is not a clear step-by-step process. The best tax preparers know that tax preparation is an interpretation of tax law. To take advantage and not fall victim to missing something, hire the best CPA your business can afford – it’s worth your peace of mind. Here’s to a smooth spring and happy filing!